How-to: How to buy tech stocks on the example of "Yandex"

Bashny.Net

Bashny.Net

In the comments to one of the last topics of our blog readers asked reveal the theme of how to buy shares of Russian Internet companies. Therefore, today we will focus on how the Russian citizen to do it, and what steps you need to do is execute. As an example of such a technology company, it was decided to take the "Yandex" - firstly, the company recently held a placement of shares on the Moscow Stock Exchange, and secondly, the purchase of its shares is often interested in our readers.

Disclaimer: This topic is of a general nature, so those who are well versed in the topic and considers this post is not very interesting for yourself, offer to share knowledge in the comments. In addition, the text includes several references to our corporate website (not everyone is like).

A bit of theory h4> Start with a small theoretical retreat and talk about how to get all the company's shares on the stock exchange, and that it can be done with them (for example, domestic Moscow Stock Exchange).

So, in order to have the opportunity to buy yl sell shares of a particular company on the stock exchange, the company, as issuer (the one who issues shares) is in the process of listing its shares on the stock exchange. According to the results of this process makes the stock exchange quotation list of 1st, 2nd or 3rd level ( List securities admitted to trading on ZAO "MICEX" as of 02.07.2014g.).

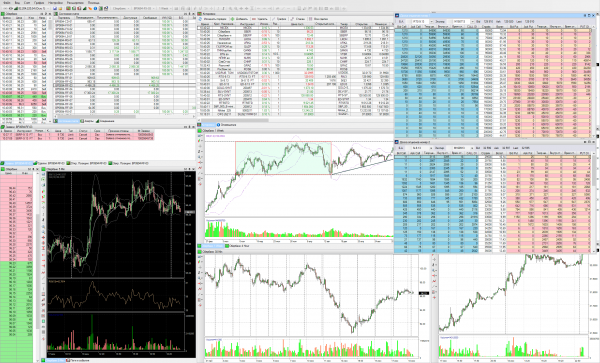

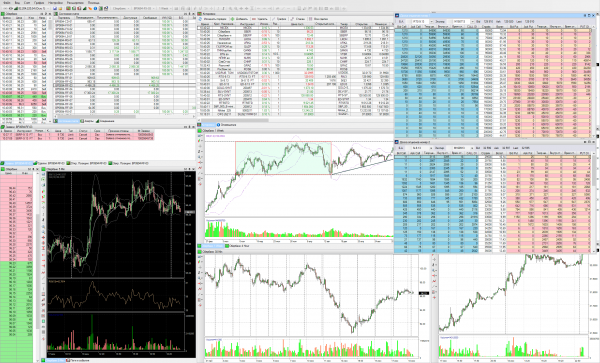

Schedule changes in share prices, "Yandex" on the Moscow Stock Exchange i>

From this point it becomes possible through the professional participant of the securities market to buy / sell shares of the company - professional participants in this case are the broker and depository (more on the Russian stock market the device can be read here and here ). To do this, the client must sign a contract for brokerage and depository services. The contract for brokerage services the client will make trades on the exchange, but under the depositary agreement with the depositary shares will be stored and accounted for client rights on them.

Buying shares, the client becomes a shareholder of the issuer and is entitled to participate in the management of the company and receive income in the form of dividends. The right to manage the client's company sells through its participation in the meetings of the shareholders of selecting the composition of the governing bodies of the company, and also held a vote on important issues. If a company as a result of their activities makes a profit, the Board of Directors may recommend to send a portion of the profits to pay dividends, and if at the general meeting of shareholders will decide on the payment of dividends, shareholders will receive income from the ownership share.

But not all shareholders will receive a dividend, only those shareholders who held shares at a certain date. The client receives the profit not only from the receipt of dividends, but also from the increased market value of the shares. In general, all the above is true both for shares representing IT-sector, as well as companies from other sectors.

It should be noted that the stock market the main source of income traders are still speculating (to buy at a lower price, selling at higher). In the comments to one of the previous topics habrapolzovatel Zerkella very well described the mechanics (though named the stock market betting, as agreed can not be), so let me quote some of his comments:

The business model assumes constant growth companies and investing in the development itself, but because the dividend payments are rare and are considered more as an adverse event (the company stopped in development and is not able to come up with profitable methods to further expand the business). Company - as a man - a growing and evolving, ever gets old and dies soon. Therefore, companies prefer to grow by investing in your business all the free money.

The usual method of obtaining income from investments in the stock market - is to buy shares at a lower price and selling at most (speculation). This is consistent with the model of constant growth of the company, and for the payment of dividends of such income is not needed. The mechanics is simple - the number of shares is constant, and the value of the company grows, as it develops, and instead of paying dividends increases its amount of assets (in the case of Yandex - buys data centers and programmers create better systems for tracking users and targeting advertising). Accordingly, increasing the cost shares. Blockquote> This means that to buy shares at today's stock exchanges in terms of dividends - not a good idea, because the company can not pay their never absolutely legally. Far more logical to rely on the growth rate of shares in order to profitably sell them (or to fall in order to take action in debt, sell and then buy back at a lower price - the so-called short-position).

How to buy stocks "Yandex" on the Moscow Stock Exchange h4> Shares "Yandex" appear in the list of securities admitted to trading on Moscow Stock Exchange (due to the fact that the company is legally overseas, as the type of securities stated "Shares foreign issuer»).

As a private person can not just trade on the exchange, intermediaries are required, the companies that are the professional stock market participants - brokers it. Accordingly, in order to buy shares (or futures and Options ), you must open an account with a brokerage company. Brokerage services are provided not only the company but also some banks (list of options for opening an account, as well as figures on the number of customers, the volume of trading of each company in a particular market of the Moscow Stock Exchange can be found here ). One of these is accredited brokers, for example, ITinvest - we have representation in different cities of Russia and in Azerbaijan's capital Baku - accordingly, information on opening an account can be found or there, or leaving application online.

After opening the account, the client can make the purchase or sale of shares and other financial instruments with the help of the trading terminal or call your brokerage company on the phone and apply for voice (after, of course, will have to prove your identity). Another option to create an automated trading system that will connect to the broker system using API and make transactions of purchase and sale on the preset algorithm .

Workspace POS SmartX i>

Important point - novice investors and traders it is not recommended immediately rush into battle on the real stock market. Far more logical to first practice on a test account with virtual money - on the Moscow Stock Exchange implemented entirely virtual stock market, which is no different from the present, including, it is possible to buy the shares virtually the same "Yandex».

The trading terminal you must select the desired market - shares of "Yandex" are traded on the stock market section. Accordingly, choose an action for the purchase in the terminal can be in a special table of quotations and buy it, make the application using a special window. After this, the shares will be credited to the account from which, in turn, will be written off the money. Similarly, the user will be able to sell the shares and get the money.

For each transaction of purchase and sale commission - it takes and Exchange Commission, and the broker. All fees Moscow Exchange listed on a special page for a more complete understanding of the potential costs, on our website тарифы include commodity exchange and brokerage fee. There are different tariff plans that are suitable for different styles in the stock market.

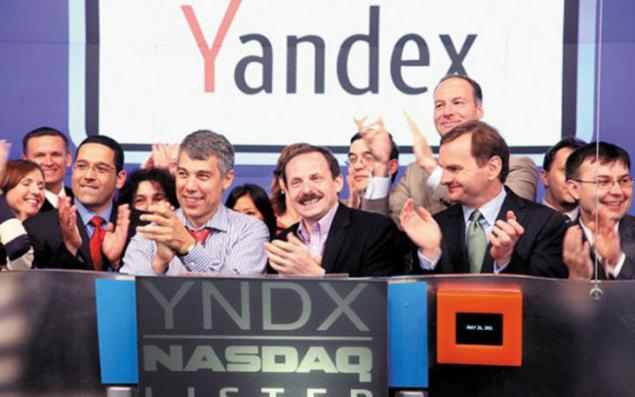

How to buy shares on foreign exchanges h4> Papers of various Russian companies traded on the set of sites abroad, the most popular are the LSE (London Stock Exchange), and New York, the NYSE and NASDAQ.

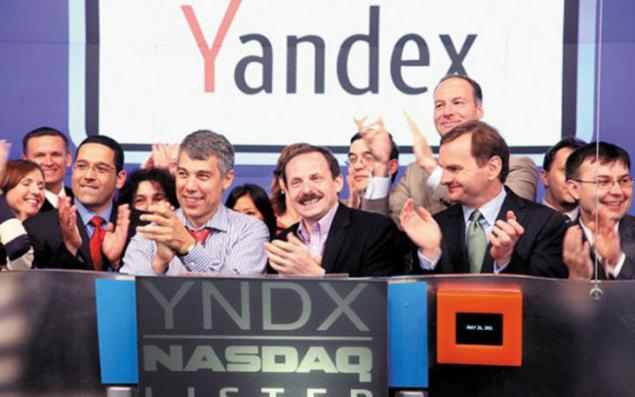

In order to trade on these exchanges, it should also apply to local or broker to open an account (which is not so easy to do) or find a Russian broker, which provides access to trading. Shares of "Yandex", which we now consider, as an example, are traded on the NASDAQ, respectively, need to be Russian broker who has access there (good post for beginners about the search options trade on the NASDAQ, you can read the здесь ).

That is all. We hope that the scheme of acquisition of shares of Russian companies are interested to become a little clearer habrapolzovateley. If you still have any questions, we will be happy to answer them in the comments.

PS If you spot a typo or a mistake, please send it to us a personal message and we will promptly fix it.

Related posts:

«Yandex" will place its shares on the Moscow Stock Exchange Как arranged exchange trade in Russia Tools Stock Market: Trading terminal Virtual Trading: the first step in the stock market < / Top 10 books for understanding the stock market the device

Source: habrahabr.ru/company/itinvest/blog/229237/

Tags

See also

How to work in a terrible company

What is an IPO and why it is needed

How to become a blogger

How to buy a bed linen and not to be mistaken with a choice?

The return of Paul Miller

HOW CHILDREN'S FINANCIAL SYSTEM on the shelves decomposed.

101 Tips for traveling by plane

Amateur photographers come from the USSR

Why still need policy

Healthcare Boom: how not to sour old