On the issue of mortgage

Bashny.Net

Bashny.Net

Introduction

In its publication on the 01/24/14, Comrade CS98rus [1] tried to justify the possibility of savings to buy an apartment of funds. In this paper we show that such a possibility under these conditions and taking into account the realities of the Russian economy is absent. The calculations take into account inflation, indexing of income and expenses. Calculations were performed using data on real estate and financial services in the city of Krasnoyarsk.

Total 7 paintings, a little text.

1 Initial data

We take the following data source [1] for the current period:

cost of an apartment 2, 5 million. rubles; area is 56 square meters. m .; the cost of renting 17 thousand. rubles per month; the cost of utilities 4 th. rubles per month; family income 55 thousand. rubles mesyats.Takzhe we need data on inflation in Russia. Let us assume that the average inflation rate is constant and calculate it from the table [2]. The calculated value of the inflation Em = 0, 799%. Then, the annual inflation Ey = 10%. We assume that the family income is indexed (increased) annually on the value of the rate of inflation. For simplicity, we assume that the rent is indexed as the value of the rate of inflation. The latter assumption is generally true: the growth rate of the rental price is almost equal to the growth rate of property value and higher than the rate of inflation.

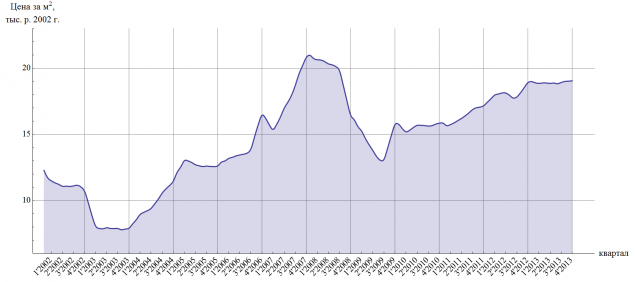

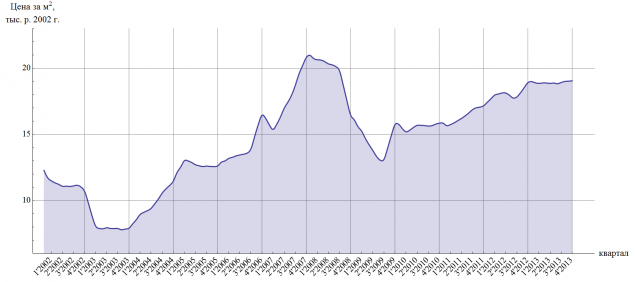

Now we estimate the growth rate of the cost of real estate in Krasnoyarsk. Figure 1 shows a graph of the cost of one square meter of secondary housing prices in the current period. For simplicity, we assume that the cost of housing increases linearly with time: 360 rubles / (Month * sq. M.). Red is a direct linear approximation of the cost curve.

2 Mortgage

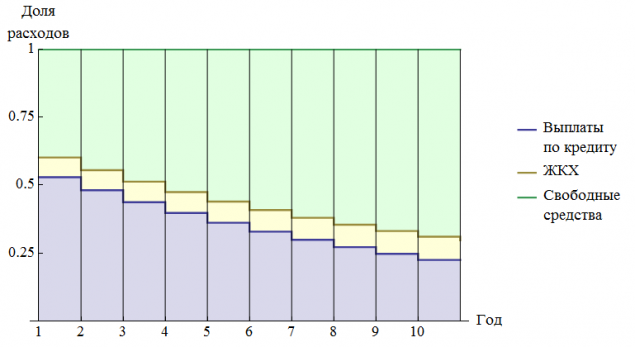

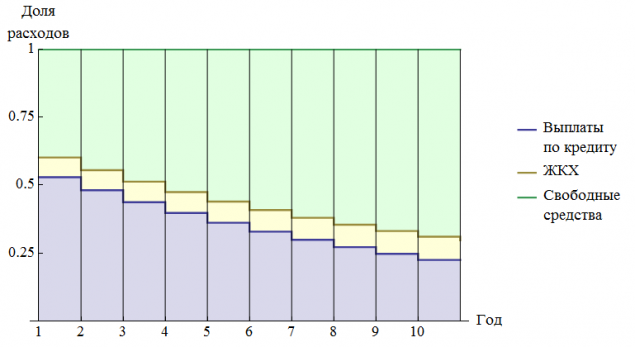

We take the best offer on the market of 2 million rubles. 10, 12, 35% per annum, 500 thousand. Rubles initial payment. Figure 2 shows the structure of household expenditure that pays the mortgage annuity (equal) payments.

3 Accumulation

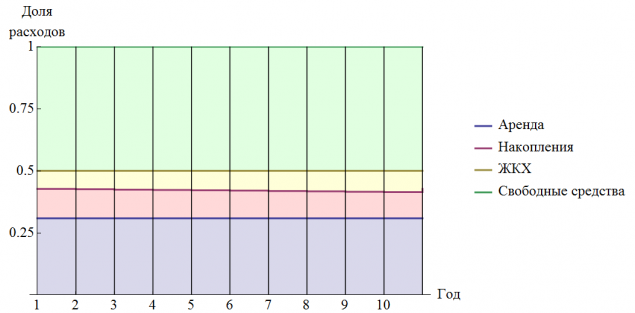

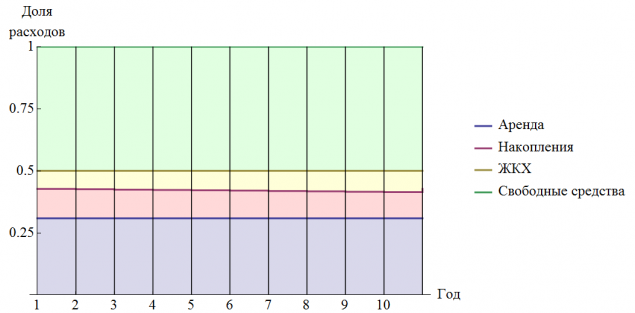

The article [1] was proposed to save the initial fee and the difference between the amount of payments on loans and the cost of rent. Thus, the cost structure will be as shown in Figure 3.

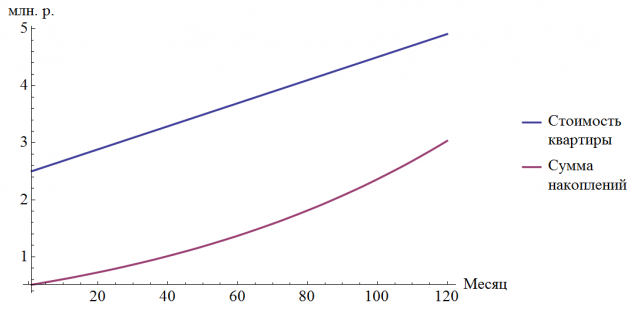

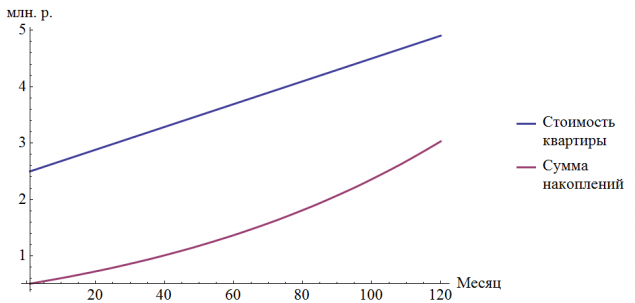

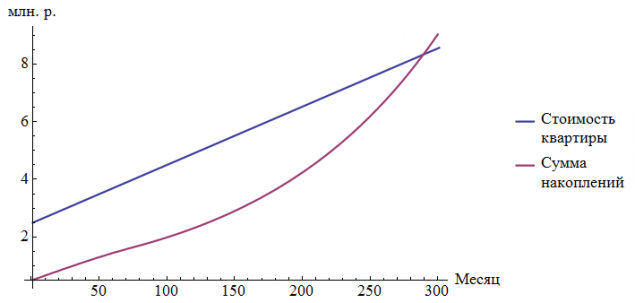

We choose the most successful offer for storage: input at 9, 5% per annum, with monthly capitalization and ability to replenish. Figure 4 shows the curves of the cost of the apartment and the amount of savings.

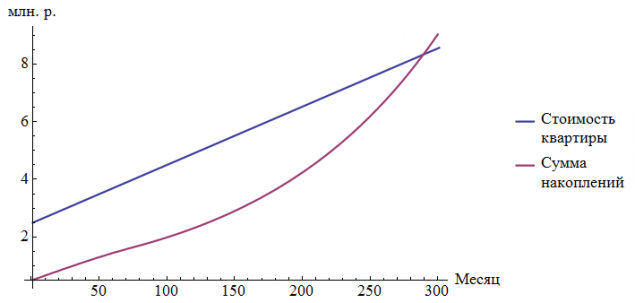

Because at some point, the cost of rent exceeds the amount of the payment on the mortgage, then the completion of the deposit is terminated. However, it should be noted that under the assumptions made to save all the same to get 290 per month.

Now suppose that there is a difference between the accumulation of half earnings and the amount of rent and utility payments. Thus, the available funds is always half the salary.

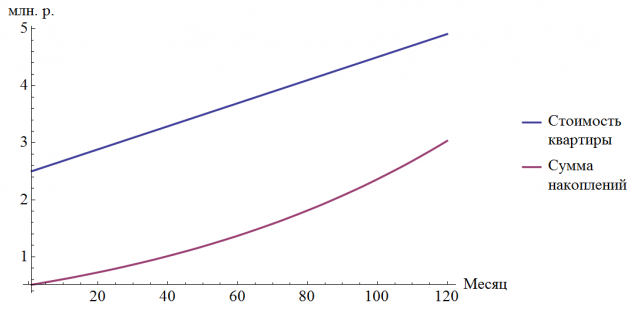

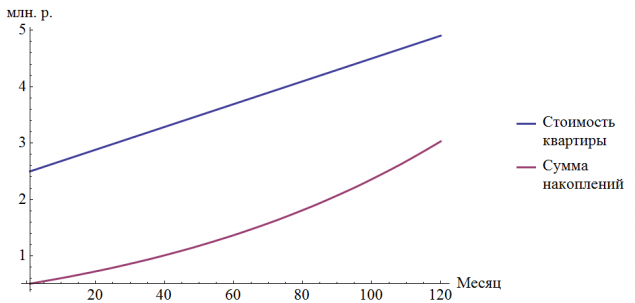

In this case, save up for an apartment for 120 months and will not work: the pace of accumulation of less growth in property values.

Conclusion

Accumulate on the flat for a time equal to the term of the loan, using the same income in the present conditions is impossible. The reason for this is the rise in value of the property, which is faster than the cheaper money and indexed wages. The figure shows the cost per square meter second homes in Krasnoyarsk in prices in January 2002. It can be seen that the rise in the cost of property is justified not only inflation, but also other economic factors that the growth of wages and savings of the population is not affected.

Source:

In its publication on the 01/24/14, Comrade CS98rus [1] tried to justify the possibility of savings to buy an apartment of funds. In this paper we show that such a possibility under these conditions and taking into account the realities of the Russian economy is absent. The calculations take into account inflation, indexing of income and expenses. Calculations were performed using data on real estate and financial services in the city of Krasnoyarsk.

Total 7 paintings, a little text.

1 Initial data

We take the following data source [1] for the current period:

cost of an apartment 2, 5 million. rubles; area is 56 square meters. m .; the cost of renting 17 thousand. rubles per month; the cost of utilities 4 th. rubles per month; family income 55 thousand. rubles mesyats.Takzhe we need data on inflation in Russia. Let us assume that the average inflation rate is constant and calculate it from the table [2]. The calculated value of the inflation Em = 0, 799%. Then, the annual inflation Ey = 10%. We assume that the family income is indexed (increased) annually on the value of the rate of inflation. For simplicity, we assume that the rent is indexed as the value of the rate of inflation. The latter assumption is generally true: the growth rate of the rental price is almost equal to the growth rate of property value and higher than the rate of inflation.

Now we estimate the growth rate of the cost of real estate in Krasnoyarsk. Figure 1 shows a graph of the cost of one square meter of secondary housing prices in the current period. For simplicity, we assume that the cost of housing increases linearly with time: 360 rubles / (Month * sq. M.). Red is a direct linear approximation of the cost curve.

2 Mortgage

We take the best offer on the market of 2 million rubles. 10, 12, 35% per annum, 500 thousand. Rubles initial payment. Figure 2 shows the structure of household expenditure that pays the mortgage annuity (equal) payments.

3 Accumulation

The article [1] was proposed to save the initial fee and the difference between the amount of payments on loans and the cost of rent. Thus, the cost structure will be as shown in Figure 3.

We choose the most successful offer for storage: input at 9, 5% per annum, with monthly capitalization and ability to replenish. Figure 4 shows the curves of the cost of the apartment and the amount of savings.

Because at some point, the cost of rent exceeds the amount of the payment on the mortgage, then the completion of the deposit is terminated. However, it should be noted that under the assumptions made to save all the same to get 290 per month.

Now suppose that there is a difference between the accumulation of half earnings and the amount of rent and utility payments. Thus, the available funds is always half the salary.

In this case, save up for an apartment for 120 months and will not work: the pace of accumulation of less growth in property values.

Conclusion

Accumulate on the flat for a time equal to the term of the loan, using the same income in the present conditions is impossible. The reason for this is the rise in value of the property, which is faster than the cheaper money and indexed wages. The figure shows the cost per square meter second homes in Krasnoyarsk in prices in January 2002. It can be seen that the rise in the cost of property is justified not only inflation, but also other economic factors that the growth of wages and savings of the population is not affected.

Source:

Tags

See also

Padonsky Slang - now and for the doctors! =)

Stasis - isometric, science fiction point-and-click adventure game (Kickstarter Campaign)

Learn to physicians

Mikhailovsk dismiss the head of the city ...

How are the competitions in weightlifting?

As covered the sky of the USSR from the USA

Recovered Army photo

Russian Post and step into the future

Unusual shop in Norway - no seller!